Life insurance is not just a policy; it’s a promise to protect your loved ones when you’re no longer around. For adults, especially those with dependents, life insurance is a critical financial safety net. It provides peace of mind knowing that your family’s financial future is secure, even if the unexpected happens.

Toc

Introduction of Life Insurance

Life insurance is a type of financial protection that provides a death benefit to the beneficiaries named in the policy upon the death of the insured individual. This death benefit can be used to cover funeral expenses, pay off outstanding debts, and provide ongoing income for dependents.

In addition to providing financial security for loved ones, life insurance can also serve as an investment tool or retirement strategy. It offers various types of policies with different coverage amounts, premium rates, and benefits. Understanding these options can help you choose the best life insurance policy for your needs.

Types of Life Insurance Policies

- Term Life Insurance: A term life insurance policy provides coverage for a specific period, usually 10-30 years. This type of policy is ideal for those with short-term financial obligations or those who want affordable coverage.

- Whole Life Insurance: A whole life insurance policy offers lifetime coverage, as long as premiums are paid on time. It also has a cash value component that grows over time and can be accessed by the policyholder.

- Universal Life Insurance: Similar to whole life insurance, universal life insurance also offers lifetime coverage but with more flexibility in premium payments and potential for higher returns on the cash value component.

- Variable Life Insurance: A variable life insurance policy allows the policyholder to invest their premiums in various investment options, such as stocks and bonds. This type of policy offers potential for higher returns but also carries more risk.

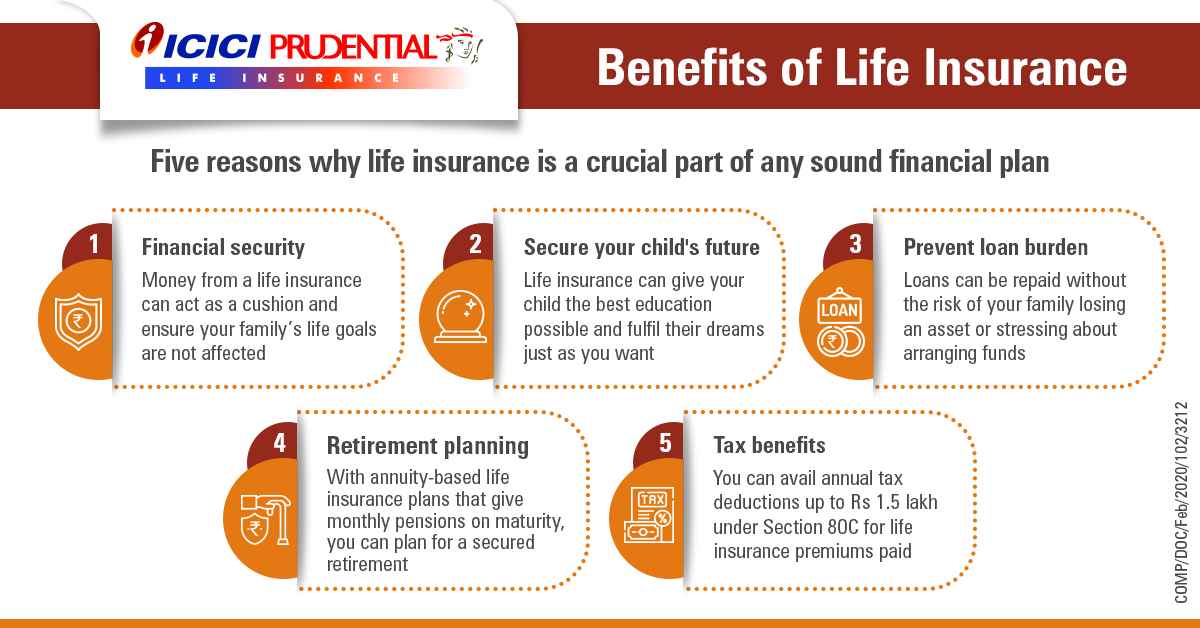

Benefits of Life Insurance

- Financial Security: The primary benefit of life insurance is providing financial security to your loved ones in case of your unexpected death. It can help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

- Income Replacement: For families with dependents, life insurance can serve as a replacement for lost income in case the insured individual passes away. This ensures that your family’s financial needs are still met, even without your income.

- Paying Off Debts: Life insurance can also be used to pay off outstanding debts, such as a mortgage or car loan. This can prevent your loved ones from inheriting any financial burdens after you’re gone.

- Tax Benefits: In most cases, the death benefit received from a life insurance policy is not subject to income tax. This means that the full amount can go towards supporting your family’s financial needs.

How to Choose the Right Life Insurance Policy

Choosing the right life insurance policy can be overwhelming, considering the various options available. Here are some factors to consider when selecting a policy:

Assess Your Needs

Before choosing a life insurance policy, it’s essential to evaluate your personal and financial needs. Consider factors such as your age, health condition, income, debts, and the financial needs of your dependents. Understanding your specific requirements will help you determine the amount of coverage you need and the type of policy that best suits your situation.

Compare Different Policies

Once you have assessed your needs, compare the different types of life insurance policies available. Look at the coverage amounts, premium rates, policy terms, and additional benefits offered by each policy. It’s also beneficial to read reviews and seek recommendations from financial advisors to gain insights into the reliability and performance of different insurance providers.

Understand the Terms and Conditions

Ensure you thoroughly understand the terms and conditions of the policy you are considering. Pay attention to details such as the premium payment schedule, the process for filing claims, and any exclusions or limitations that may apply. Clarifying these aspects beforehand can prevent any potential issues or surprises in the future.

Review Your Policy Regularly

Life circumstances can change over time, so it’s important to review your life insurance policy regularly. Major life events, such as marriage, the birth of a child, or significant changes in income or health, may necessitate adjustments to your coverage. Periodic reviews ensure that your policy remains aligned with your current needs and goals.

Seek Professional Advice

If you’re uncertain about which life insurance policy to choose or how much coverage you need, consider seeking professional advice. Financial advisors or insurance brokers can provide valuable insights and help you navigate the complexities of life insurance. Their expertise can guide you in making informed decisions that protect your financial interests and those of your loved ones.

Common Misconceptions About Life Insurance

Despite its many benefits, there are still some misconceptions surrounding life insurance. Here are a few common ones:

It’s Too Expensive

Many individuals believe that life insurance is unaffordable, particularly younger people or those on a tight budget. However, life insurance can be more affordable than you might think. Term life insurance policies, for example, often have lower premiums and can provide substantial coverage for a set period. Additionally, buying life insurance at a younger age can lock in lower rates and provide financial protection when it’s needed most. It’s crucial to explore different types of policies and get quotes from various providers to find one that fits your budget.

Only Breadwinners Need It

Another common misconception is that only the primary income earner in a family needs life insurance. In reality, stay-at-home parents, caregivers, or anyone contributing to the household can benefit from life insurance. The financial value of the services provided by non-income earners, such as childcare, housekeeping, and more, is significant. Life insurance can cover the cost of these services if the person responsible is no longer able to provide them, ensuring the family is not left struggling financially.

Employers Provide Enough Coverage

While many employers offer life insurance as part of their benefits package, the coverage is often insufficient for comprehensive financial protection. Employer-provided policies typically offer a death benefit equal to one or two times the employee’s annual salary. Considering the costs of outstanding debts, mortgage payments, and living expenses, this amount is usually not enough to ensure long-term financial security for your loved ones. It’s wise to have an additional individual policy that supplements the coverage provided by your employer.

Health Conditions Make It Impossible to Get Covered

Some people believe that having a pre-existing health condition means they won’t be able to get life insurance. While it’s true that such conditions may affect premiums or eligibility for certain types of policies, there are still options available. Many insurance providers offer policies specifically designed for individuals with health issues, though the terms and rates may differ. It’s essential to shop around and speak with insurance agents who can find policies that accommodate your health status.

Life Insurance is Only for After Your Death

People often think of life insurance solely in terms of its death benefit. However, certain life insurance policies offer benefits that can be accessed while you are still alive. For example, whole life and universal life policies have a cash value component that grows over time. This cash value can be borrowed against or even withdrawn in some cases, providing financial flexibility for emergencies, education expenses, or retirement. Understanding the living benefits of life insurance can add an extra layer of financial planning to your overall strategy.

The Process of Getting Life Insurance

The process of getting life insurance involves several steps, including:

Research and Compare

Initial research is crucial in selecting the right life insurance policy. Start by identifying your needs and the amount of coverage required. Use online tools and resources to compare different policies, premiums, and benefits. Pay attention to customer reviews and ratings for various insurers to gauge their reliability and customer service quality. It’s also beneficial to consult comparison websites that provide side-by-side evaluations of different policies and plans.

Obtain Quotes

Once you have shortlisted potential policies, obtain quotes from multiple insurance providers. This step allows you to compare costs and see which policy offers the best value for your budget. Many insurers offer online quote calculators, making it easier to get preliminary estimates without having to contact an agent. Remember to provide accurate information when requesting quotes to receive the most precise estimates possible.

Application and Underwriting

After selecting a policy, the next step is to complete the application process. This typically involves filling out a detailed form that asks about personal information, health history, lifestyle habits, and sometimes undergoing a medical exam. The insurer uses this information during the underwriting process to assess your risk and determine the premium amount. Depending on the policy type and the amount of coverage, the underwriting process can take anywhere from a few days to several weeks.

Policy Approval

Once the underwriting is complete, the insurer will notify you if your application has been approved. If approved, you will receive the final policy document, which outlines the terms and conditions, premiums, coverage details, and any exclusions. Review this document carefully to ensure it matches what was discussed and agreed upon.

Payment and Policy Activation

To activate your life insurance policy, you will need to make the initial premium payment. Policies can often be paid monthly, quarterly, semi-annually, or annually, depending on what the insurer offers and your preference. Once the payment is made, the policy becomes active. It’s important to keep up with premium payments to maintain coverage.

Store Documents Safely

After your policy is activated, store all relevant documents in a safe and accessible place. Inform your beneficiaries about the policy and where the documents can be found so they can easily access them if needed. Keeping electronic copies can also be useful for quick reference.

Periodic Reviews and Updates

Finally, remember to periodically review and update your life insurance policy to ensure it continues to meet your needs. Life changes, such as marriage, the birth of a child, or significant financial shifts, may require adjustments to your coverage. Regular reviews and updates will help maintain the effectiveness and relevance of your life insurance policy over time.

Real-Life Case Studies

To better understand the importance and benefits of life insurance, here are a few real-life case studies of individuals who have experienced its impact firsthand:

Case 1: Protecting Loved Ones from Financial Struggle

John was the sole breadwinner for his family, with a wife and two young children. Tragically, he passed away in an accident at work. Fortunately, John had a comprehensive life insurance policy that provided enough coverage to pay off the mortgage on their home, outstanding debts, and continue supporting his family’s living expenses. Without this financial safety net, John’s family would have struggled significantly after his passing.

Case 2: Covering Critical Illness and Medical Expenses

Sarah was diagnosed with a severe illness in her early forties. Despite having health insurance, the medical bills and associated costs began to pile up, threatening her financial stability. Thankfully, Sarah had a life insurance policy with an accelerated death benefit rider. This rider allowed her to access a portion of her policy’s death benefit to cover the critical illness expenses. The funds from her life insurance policy enabled Sarah to focus on her recovery without the added stress of financial worries.

Case 3: Funding Children’s Education

David and Emily were committed to providing the best education for their two children. They realized that in the event of either parent’s untimely death, the dream of a quality education for their kids could be jeopardized. To safeguard their children’s future, they purchased life insurance policies with sufficient coverage to ensure that their children’s educational expenses would be covered. When David unexpectedly passed away due to a heart attack, the life insurance payout provided the means to secure his children’s educational futures, honoring his and Emily’s commitment to their family’s aspirations.

Case 4: Supplementing Retirement Income

Tom and Lisa owned a successful small business for many years. They invested in a whole life insurance policy early on, accumulating cash value over time. As they approached retirement, they discovered they had accumulated substantial cash value in their policy. They were able to borrow against this amount to supplement their retirement income, enabling them to enjoy their golden years comfortably without the fear of outliving their savings. This strategic use of their life insurance policy showcased the versatile financial tool it can be beyond just a death benefit.

Conclusion

Life insurance is a crucial component of a comprehensive financial plan, offering protection, flexibility, and peace of mind. Whether it’s safeguarding your family’s financial future, covering critical illness expenses, ensuring educational opportunities, or providing additional retirement income, life insurance serves multiple purposes beyond its traditional role. By understanding the various types of policies and benefits available, individuals can make informed decisions that align with their specific needs and goals. Regularly reviewing and updating your coverage ensures that your policy remains relevant and effective, providing security and support when it’s needed the most.